Let’s quickly examine very briefly what just happened, then the response, and then the specific responses so far in our industry.

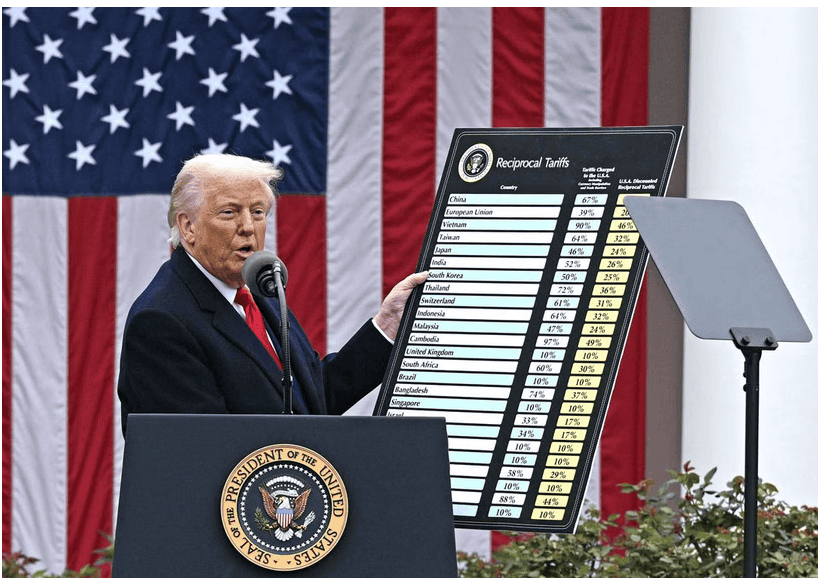

The White House just announced high tariffs around the world, including all the main garment producing countries, particularly high on China, Vietnam and Bangladesh. The only exception is Mexico, but those are presumed to be enacted shortly.

The international garment trade is inevitably going to be affected, and perhaps less obvious so will the domestic garment industry. Stocks have plummeted to lows only seen at times of natural disaster. If you want to bet on crappy food and folks killing themselves you might be ok in stock as Dollar General and tobacco stocks are up. Investing in anything else rights now, we don’t see only doom. Will we see great increases in domestically produced garments? We can hope we will see some, but the challenges are many.

– the administration changes their alleged minds sometimes hourly. Would you commit tens of millions right now to build factories in the USA on the premise that tariffs will all continue until you could reap the benefit?

– domestic producers aren’t buying American-made sewing machines or all their fabric or zippes or buttons and costs will go up for those items. Energy prices are also spiking already.

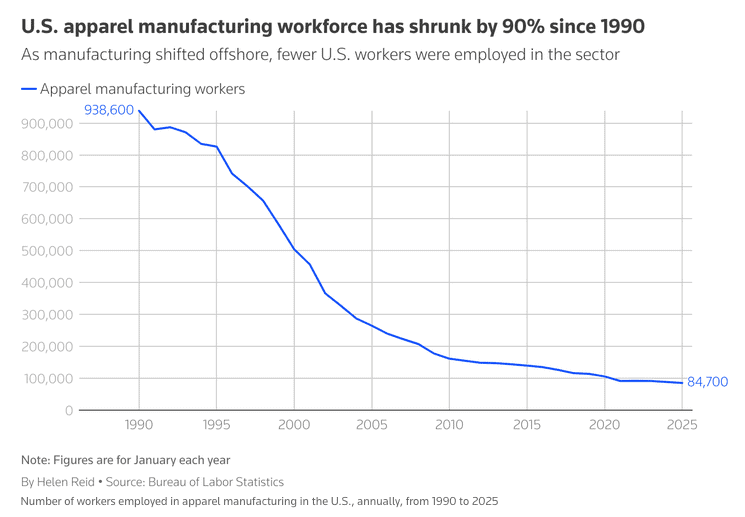

– the labor market is tight and the sewers have traditionally been recent immigrants and the cruel deportations we are seeing is not going to make that go well. If you go into any American sewing factory right now, it does not look like an American high school.

– This might spur automation innovation, but cutting is already greatly automated but sewing has resisted breakthroughs beyond some specific tasks like sewing on pockets.

– It isn’t just that the sewing factories have mostly disappeared in the US, the entire support structure for the garment industry has disappeared in all but Los Angeles and to a lesser degree the Carolinas. Who does your lab dips, repairs your sewing machines, and on and on.

“We don’t have the labor, skill set, materials, and infrastructure” to manufacture clothing and shoes on a large scale, Lamar said.

–

You may have seen emails from the CEO’s of our now only two big suppliers of garments S&S/Alphabroder and SanMar.

Short version then the whole thing…

S&S: Stay tuned, two weeks no price increases. and we’ll give you credit line increases.

SanMar: No price increases until June 1 and then only one increase. They will shift what they can from high tariff countries to lower tariff countries and together with the prediction that some countries will negotiate lowering of tariffs, then 2026 would see price decreases.

Good luck to all of us as most business does not thrive on chaos.

Here are full statements by S&S and SanMar

SanMar

As you are no doubt aware, the White House announced reciprocal tariffs on April 2. These included a baseline 10% tariff on all imports, in addition to incremental tariffs on a country-by-country basis. This process is still playing out. Some countries are negotiating to lower tariffs while others are increasing their tariffs to match.

While we will learn a lot more in the days ahead, I want to give you an idea of what to expect and how it might affect pricing.

The new tariffs begin at 10% and go as high as 50% for countries that run significant trade imbalances with the United States. While our supply chain is diverse—we produce in 24 countries—all of our factory partners are affected by tariffs to some degree. This includes Vietnam (46%), Bangladesh (37%), Myanmar (44%), Madagascar (47%), Sri Lanka (44%) and China (34%). The reciprocal tariffs are stacked on top of any existing tariffs, meaning that the new tariffs on China are added to the 20% tariffs instituted earlier this year.

What this means for you:

- In the short term, SanMar will begin to pay the new tariffs. We have production orders placed many months in advance. We’ll honor those orders with our partners and begin to import goods at the new higher prices.

- We’ll make a single price change starting June 1, with the plan to hold that change through 2025. Instead of a product-by-product or country-by-country approach to pricing, we’re working to determine an increase that is sufficient to balance the higher rates from the countries listed above with the lower rates from other SanMar sourcing destinations. Our thought is that this simplifies things and makes pricing more predictable. While it won’t be an insignificant amount, we will do everything we can to minimize the increase. We’ll update you next week with full details.

- As soon as possible, we’ll shift as much production as we can from high-tariff to low-tariff countries like Honduras, where we make most of our Port & Company and District t-shirts.

- If that strategy is successful, and if countries can negotiate lower tariffs, we would expect that prices will come down in 2026.

We’re with you, and we’re here for you.

During the past several years we all learned to pivot, be entrepreneurial and add value in any way we could. We’ll do the same now.

If you need help finding a replacement product to meet your budget, or if you need a little extra help with credit, please contact our dedicated teams. As always, we’re here to support you.

We know this is a challenging time, and we’re all in it together. We appreciate your business and the trust you put in SanMar.

Best,

Jeremy Lott

President & CEO

S&S:

Chief Executive Officer

S&S Activewear

Comments