There is an article in the NY Times this week (sorry, but you might get a read for free, but most likely it is behind a paywall) about check fraud. I had heard that thieves were stealing checks out of mailboxes and then erasing them with chemicals and changing the payee to them and then making an account which can’t be traced and taking the money and running. I did not know that stolen checks are being offered for sale on the dark web. I did not know that they are also being stolen at the post office, at the receiving company, at the bank, and even stolen in ways that confound investigators. I did not know that four common chemicals can be used to “wash” checks. Losses are in the billiions to consumers, businesses, and banks, never mind the tremendous hassles to all involved.

The Federal Reserve reports, “The check is fading away as a consumer payment method – the number of checks collected by the Federal Reserve annually has plummeted 82% over the last 30 years”. So why is check fraud suddenly rampant?

Last year, banks issued about 680,000 reports of check fraud, nearly double what they reported in 2021. And one expert predicted total check fraud will hit $24 billion in losses this year, roughly twice what it was just five years ago.”

According to the FBI, 70% of U.S. organizations reported check fraud, resulting in more than $18 billion in losses. For financial institutions, the average phony check or money order scam resulted in $1,500 in losses per item, according to the Better Business Bureau.

Exact losses are not clear, but crazily substantial.

Usually banks in the end are responsible if they accept a check from your account that you did not write. However, if you wrote a check for $200 and somebody altered the check and stole $5000, the bank is not paying you that day and you will have to wait for your money. So you want to do everything you can to do your part to prevent check fraud.

Here are some solutions offered by the Federal Reserve, none foolproof but they help:

- Deposit mail containing checks in boxes close to collection times or only inside post office locations

-

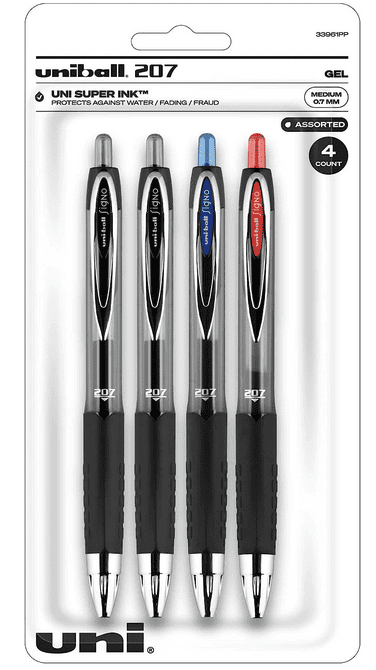

A great place to mail your postcards, but maybe not a great place to mail a check. - Use pens with permanent ink that can’t be removed through washing techniques (some sites recommend to use a pen with blue or black non-erasable gel ink, as “gel ink soaks into paper and is more difficult to remove than ballpoint-pen ink.” Some mentioned to select from: Pilot G-2 0.38. Uniball 207 Gel Pen. Sharpie S-Gel.)

-

Pens are even being sold now as for use in preventing fraud. - Monitor and balance checking accounts regularly to quickly spot anomalies

- Consider using “Informed Delivery,” a free U.S. Postal Service option that sends you a picture of your mail before delivery, so you can determine if anything is missing after it arrives

- Whenever possible, switch to secure electronic payment methods.

So get a good pen, avoid checks, go to the post office and all of that still might not work, so maybe hit the spiked eggnog a little harder to not think about all this.

Comments